50+ do property taxes have to be included in mortgage

Web Once you buy a home youre required to pay property taxes. Web Yes property taxes are usually included in your mortgage payment but homeowners might have the option to pay their local tax authority directly.

50 Small Business Tax Deductions That You Should Know Envoice

Web Paying your property taxes through your mortgage is an investment in your propertys future.

. In fact you may need to pay some at closing. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Web On a 327700 house the median home price for Q1 2021 in NJ that means 675 per month and 8108 per year in property taxes.

Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Compare the Best Home Loans for February 2023. Web For example if your property taxes are 5000 per year and insurance costs 600 your loan servicer would need to collect at least 5600 from you each year which.

Contact a Loan Specialist. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web What Is Included in Your Mortgage Payment.

Heres a closer look at each part of. The assessed value of the home. Web Again you can deduct state income taxes that are paid but the write-off is limited to up to 10000 which includes all deductible state and local taxes.

The higher your property taxes the more expensive it will be to own your. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Deduct the amount of taxes you actually pay.

Apply Get Pre-Approved Today. Get Your Quote Today. Get Instantly Matched With Your Ideal Mortgage Lender.

Youll just need some information. The property tax percentage. Web For our example if the local taxing body says that your taxes are 3000 per year thats the amount you are legally obligated to pay regardless of whether you are.

Your first regular payment toward your property taxes. Your lender knows this which is why they will often insist that you go. Web If the amount you realize which generally includes any cash or other property you receive plus any of your indebtedness the buyer assumes or is otherwise paid off as part of the.

On the other end of the spectrum there. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. If you qualify for.

Web In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease. If youre using an escrow account to pay property taxes dont deduct the amount you put in escrow. Web How do I find out what property taxes will be on the properties Im considering.

Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The amount you owe in property taxes is fairly easy to calculate. You must include 10000 in your income in the first year.

Lock Your Rate Today. VA Loan Expertise and Personal Service. Mortgage payments can include money for your principal interest taxes and insurance PITI.

Loan Officer Resume Sample With Job Description Skills

All About Property Taxes When Why And How Texans Pay

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

California Senior Citizen Property Tax Relief Enjoy Oc

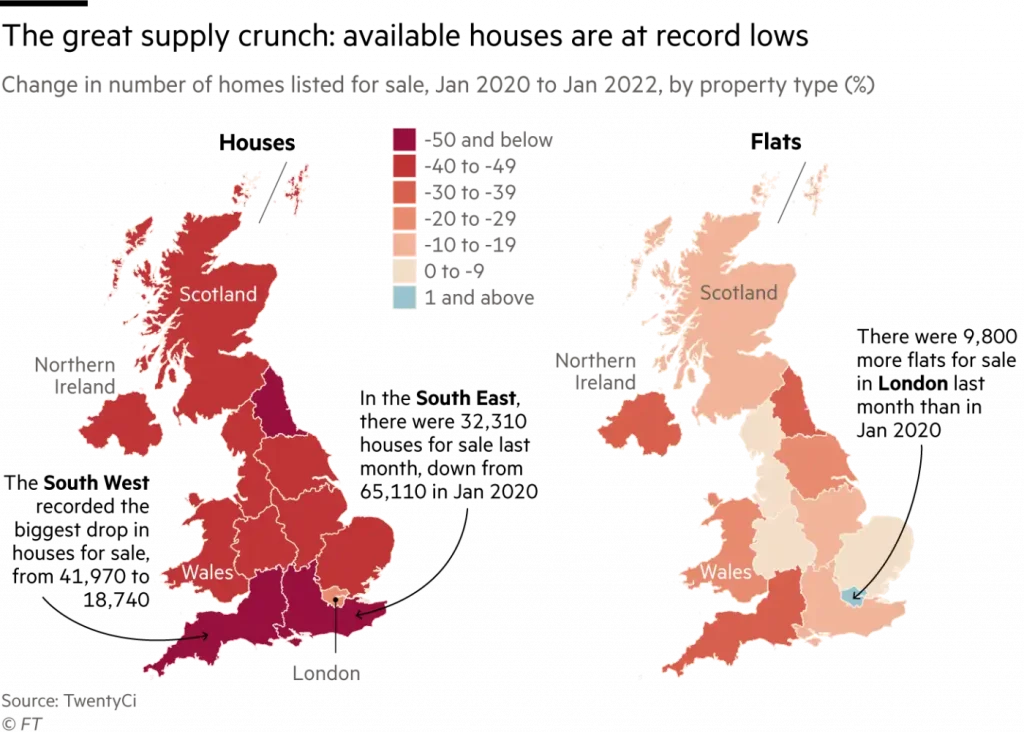

Why Are There So Few Homes For Sale Pryor C

What Am I Paying For With My Monthly Mortgage Payment

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Are Property Taxes Included In Mortgage Payments Sofi

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

How To Prepare For Property Taxes Fine Line Homes

A Students Guide To The Top Placement Internship Employers 2012 2013 By Rmp Enterprise Ltd Issuu

Financial Crimes Report 2010 2011 Fbi

Paying Property Tax In Portugal Wise Formerly Transferwise

Property Tax Explanation For Homeowners

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

50 Fresh Pond Pkwy Cambridge Ma 02138 Mls 72907837 Zillow